Let's talk about Autonomous Traders

There are many initiatative that try to create software able

to buy and sell financial assets (stock, foreign exchanges, etc) in an

autonomous way. There are some digital platforms that allow

thedevelopment, test and

deployment of trading agents

(or robots)in simulated or real markets.

In fact, autonomous trading robots have been

studied in artificial

intelligence area for some

time. Some of these work

focus on very short

horizons of investment (often called high

frequency trading), while

others deal with longer periods.

These autonomous strategies may be

created with some simple idea (moving averages, for instance), or more

complex approaches including the use of complex Artificial Intelligence

algorithms. The spectrum of

used AI techniques in

finance field is wide and it includes

more recent approaches like convolutional neuralnetworks and deep

reinforcement learning.

There are many cases, where the

developers are successful in

creating robots with

great performance when

executing with historical price

series (so called backtesting).

Furthermore, some electronic platforms

make available thousands of

robots that [allegedly] are

able to be profitable in real

markets.

Nevertheless, when these robots are

used in real markets

(or data not used

intheir training or evaluation)

frequently they present very

poor performance and high

variance of returns.

Building Reliable Autonomous Traders is a VERY complex task that

require dealing with several challenging, as we will see...

Algortitms that can invest [

better than people] ??

“Few people

have what it takes to be great investors. Some can be taught, but not

everyone . . . and those who can be taught can’t be taught

everything.

Valid approaches work

some of the time but not all. And investing can’t be

reduced to an algorithm and turned over to a computer. Even the best investors

don’t get it right every time.

The reasons are simple.

No rule always works. The environment isn’t controllable, and

circumstances rarely repeat exactly.

Psychology plays a major

role in markets, and because it’s highly variable, cause-

and- effect relationships aren’t reliable. An investment

approach may work for a while but eventually the actions it calls for

will change the environment, meaning a new approach is needed. And if

others emulate an approach, that will blunt its effectiveness.”

The most important thing: uncommon sense for the thoughtful investor.

Howard Marks. Columbia Press. 2011 -

“This is that rarity, a useful book."--Warren Buffett

What happens if Algo Traders

become ubiquitous?

- Would everybody become rich or at least present

very high average returns on their investments?

- The short answer is no.

- We believe the scenario described by Eugene Fama

[6] in his Efficient Market Hypothesis (EMH) would take place.

- The EMH states that financial markets are

efficient in pricing assets. Asset prices would reflect all information

publicly available and the collective beliefs of all investors over the

foreseeable future.

- Thus, it would not be possible to overcome the

performance of the market, using information that is known by the

market, except for simple chance

How

hard is Autonomous trading?

- The environment faced by the

autonomous investment analysts could be classified in a classic way as:

- partially observable,

- sequential,

- stochastic,

- dynamic,

- continuous

- and multiagent,

- Which is the most complex environment

class

- However, it does not really

represents the whole complexity of the problem.

- More than stochastic, such

environment is also a non-stationary process (Probability distributions

do change along the time) and it is also strategic in the sense that

two traders compete for a more accurate valuation of assets and their

actions may change other agents’ behavior.

Many exciting Opportunities and

Technologies..

- Deep Learning

- Convolutional neural networks tem

apresentado execelentes resultados no processamento de imagens, mas

também em análises de séries temporais

(preço, volume,etc.) e podem ser muito úteis na

construção de novos algoritmos

- The deep network approach has been

tested in different tecnhiques with promising results...

- Deep Reinforcemente Learning

- Deep Bayesian Networks

- Agent based Simulations

- Cognitive Computing

- Specially Natural language

processing, Sentiment analysis and human-computer interaction

- A Small Market (like Brazil) may take

more time to adjust to new information, it gives opportunities to Algo

trading to explore it

Framework

mt5bse

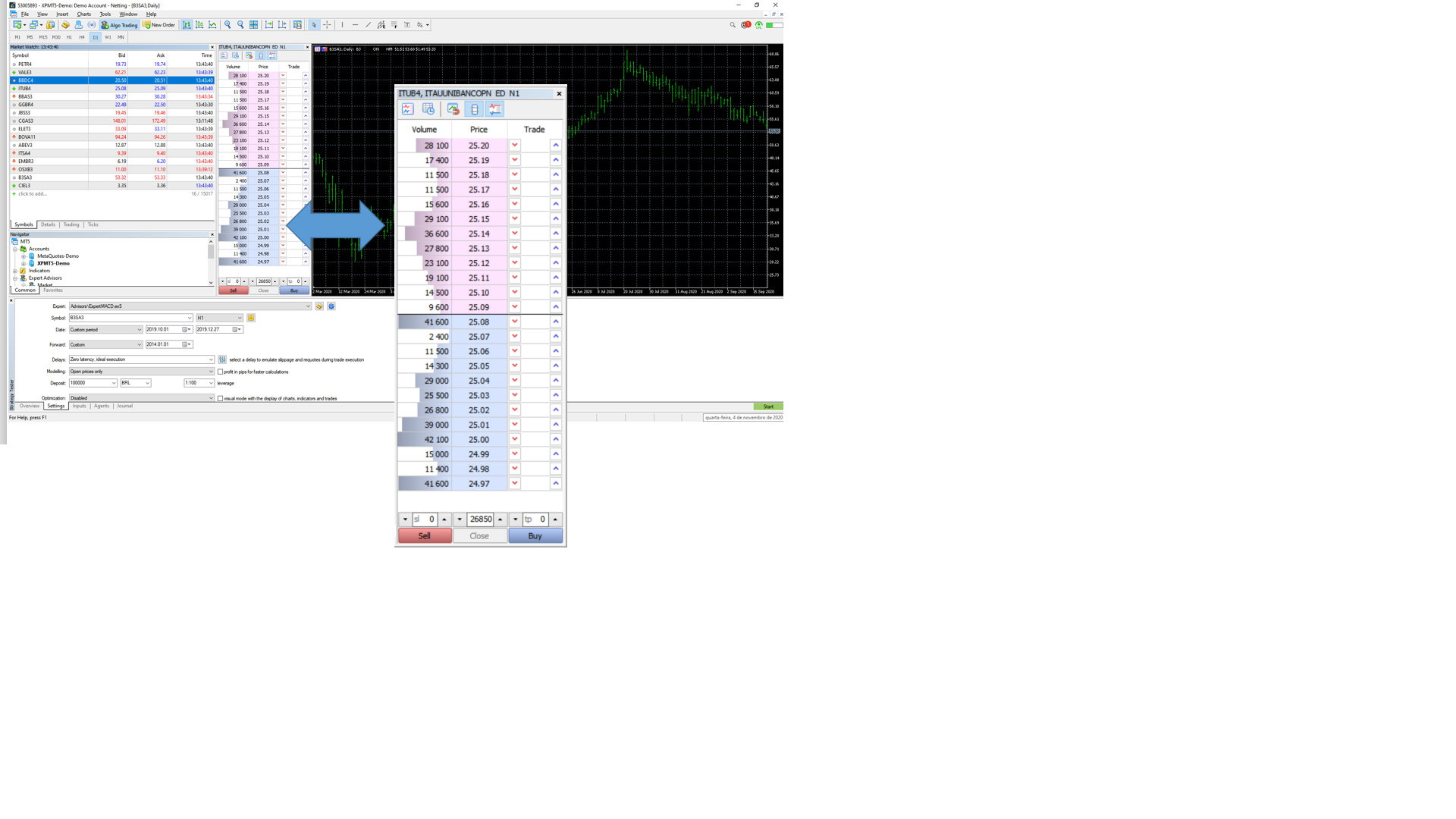

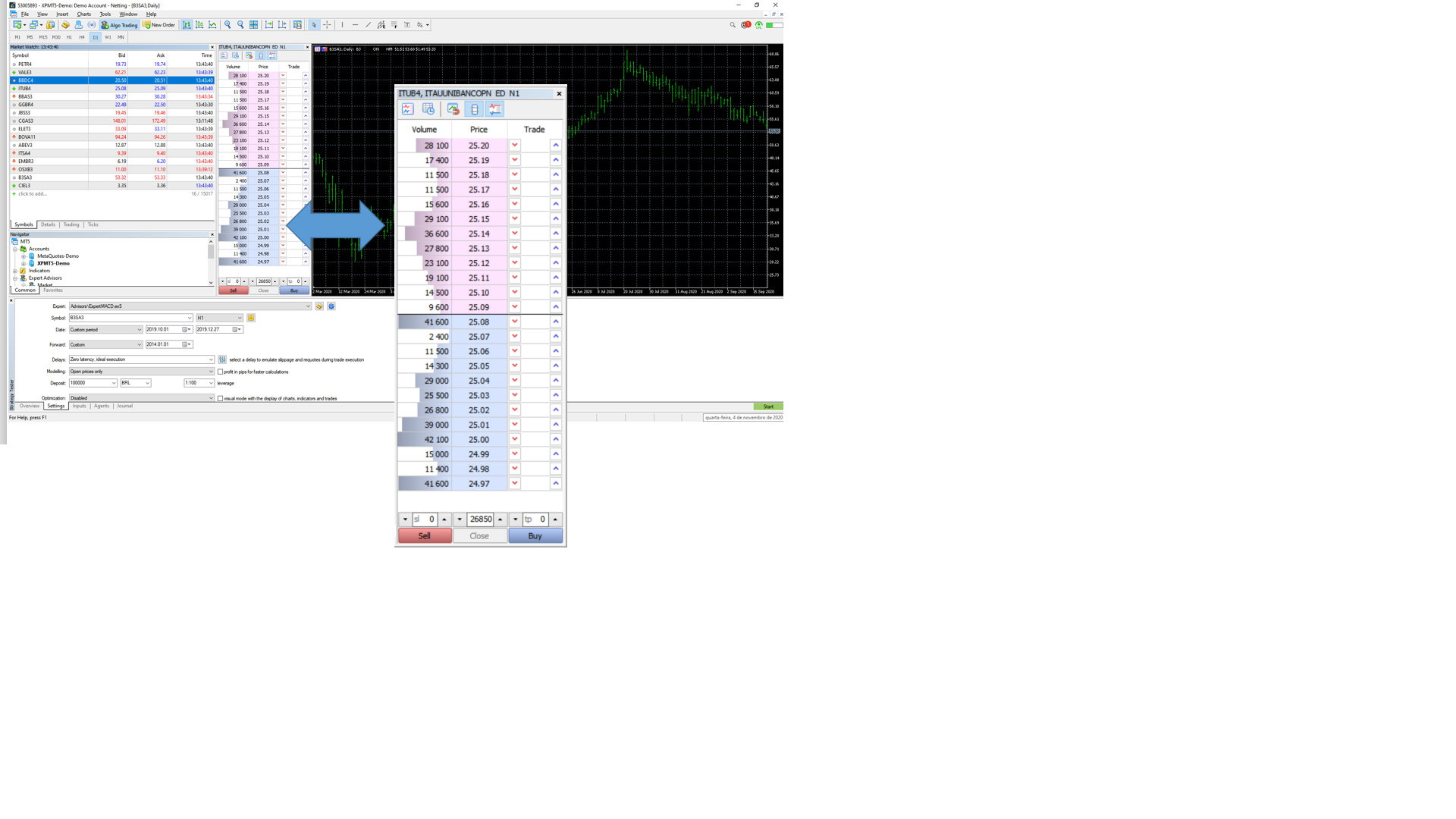

The framework mt5se provides access to the Stock

Exchange markets to python programs through Metatrader and

some Brazilian brokers (XP, Clear corretora, and others...)

It allows access to price data (open, close, high, low) and book data

(bid, ask) and it also allows order placement.

mt5se provides an API and facilitates the creation of

autonomous traders based on traditional algorithms or AI techniques

Primary information source:

https://github.com/paulo-al-castro/mt5se/

Notebooks, examples and tutorials

Metatrader 5

MetaTrader 5 is a multi-asset platform offering trading

possibilities and technical analysis tools, as well as enabling the use

of automated trading systems (trading robots). MT5 is a product of

MetaQuotes Software Corp.

MT5 uses a proprietary language called MQL5, which is similar to C++.

It is not an open source software, but it is free to use by retail

investors and traders

URL: https://www.metatrader5.com/

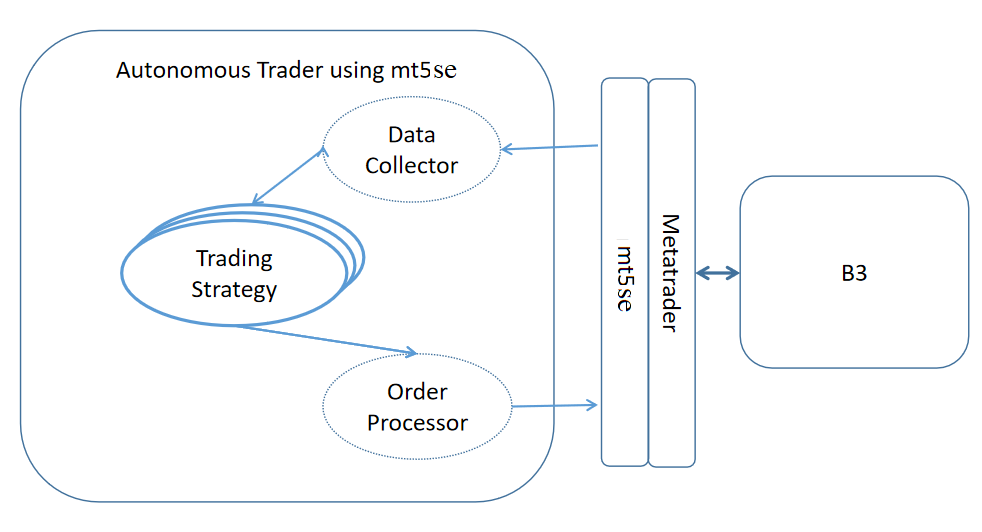

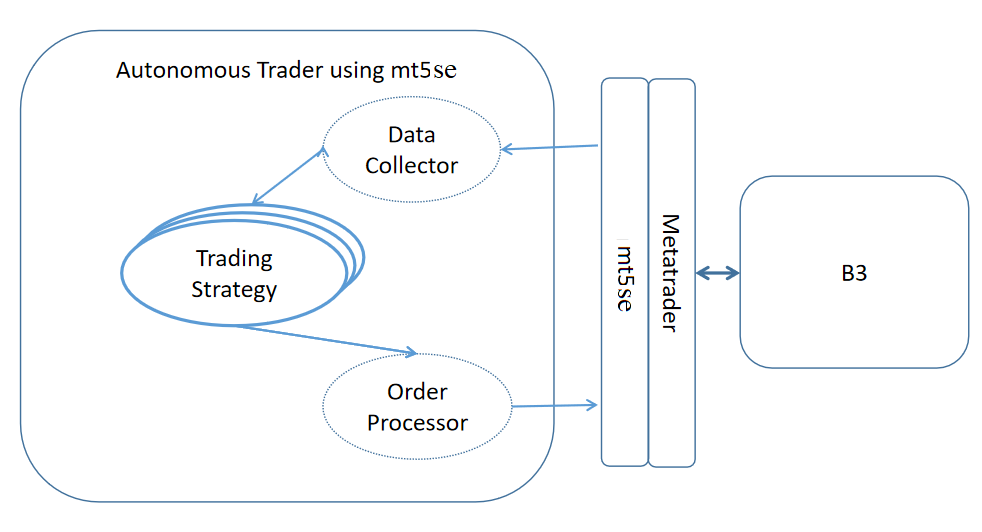

- Data Collector: According to

theStrategy, there are setof data points

that needs to be

collected and properly stored

in theMarket informationin a

continuous way. That is the role of the Data collector

component.

- Trading Strategy: it

is the implementation of

the function that decides the Robot’s

actions according to current portfolio and Market situation. It can

arbirtraly complex and it needs to deal with market prediction and risk

management.

- Order Processor:

Once the Strategy decides which orders to submit

according to the observed Market information and current portfolio.

These orders are dispatched to

some Market (real orsimulated) by the

Order processor component to be completely or partially executed or

even not executed according to the market conditions. The order

processor also updates the portfolio

information according to the

result of the submitted orders

For an Introduction to Building Autonomous Traders with mt5se. Click here